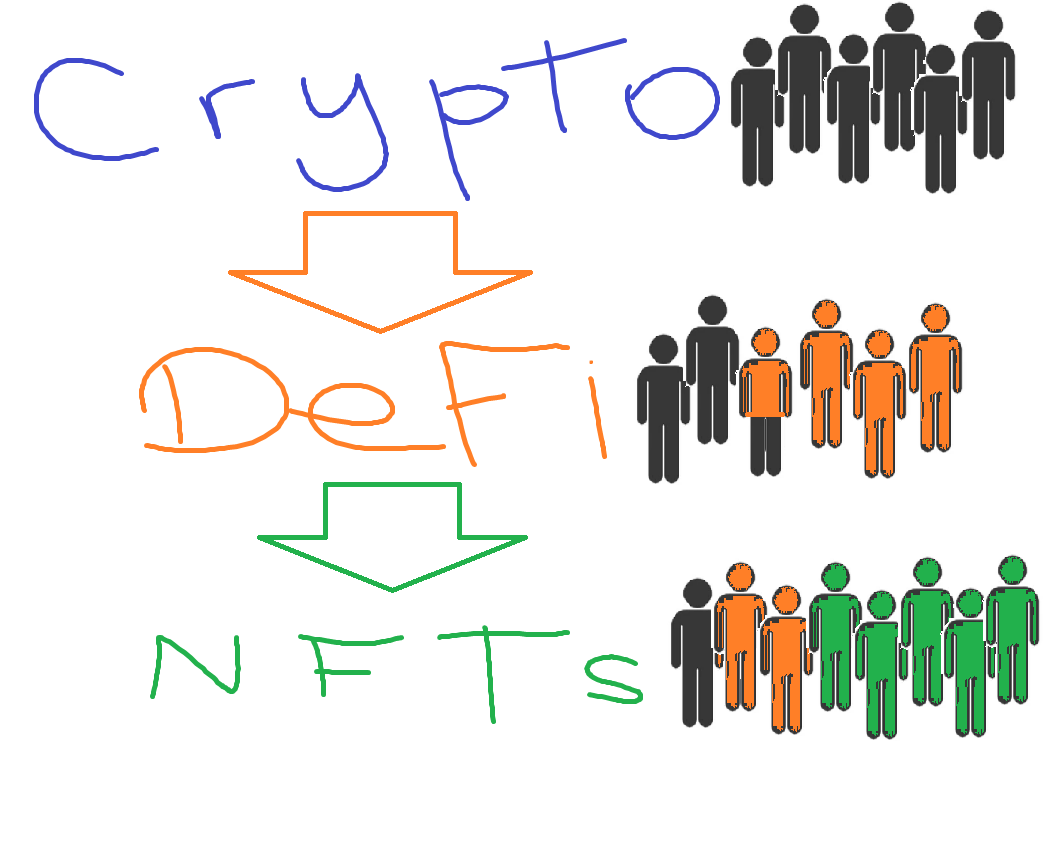

The Great Disconnect: Crypto-DeFi-NFTs

With Education and Mutual Respect, It Doesn't Have to Be This Way

Many months ago, one Fall evening in Washington Square Park in NYC, I got into separate and varied conversations with a number of people about Crypto, DeFi, and NFTs. The revealed attitudes and phobias were surprising. Only three of six or seven people held cryptocurrencies, with just one being active in NFTs. The two crypto-only hodlers were suspicious and doubtful of both DeFi and NFTs. This was in a thriving, socially vibrant, forward-thinking sample of NYC smack in the middle of itself, not long before the first NFTNYC. What’s happening?

But there’s more.

In the first ‘DAO’ or supposedly decentralized autonomous organism I joined, a veteran of that DAO expressed amazement and trepidation at my suggestion that he visit other blockchains Off-Eth. I was shocked too. He hadn’t gone to other chains, and was —and was actually afraid of that? I mean, that’s what Crypto is all about, right? Different economies. Alt-szn. The multi-verse without Marvel. Foreign exchanges with different coin offerings. Like, you probably don’t want to hear what I went through to get some Kusama (KSM) currency. It was painful but well worth it. Because before NFTs got me I was and am still a Bro of the Crypto. Or something like that (cringe faces expected and accepted). And within that admittedly corny phrase was the problem: my fellow DAOer was NOT a Crypto Bro. He was an NFT Bruh. And they’re very, very different (but don’t have to be).

Cryptocurrency’s Kids: DeFi and N.F.T.

With the current state of the markets - Traditional, Crypto, and NFTs - being what they are, I thought it would be a good time to ponder what has happened to Crypto and its ‘kids’ before further widening of The Great Disconnect. In my humble estimation, a Crypto Bro is one who is fluent in a multitude of currencies out of necessity, because that’s all there was before the flourishing of DeFi - aka DeFi Summer 2020 - and the subsequent NFT explosion. All we had was coins and charts. There was no fancy protocol or cool art to hide in when mighty Bitcoin roared its mighty tantrums from one exchange to the next. You looked for people that had good TA (technical analysis) or seemed to. Eventually, Crypto made you smarter. You had to be. There was no shallow side of the pool.

A coin you wanted might have been on Binance, and only that. Or Kucoin. Or Vindax. You got your VPN - if you had to - and went in. One day it took that entire day for my withdrawal to clear from Vindax (a Viet Nam exchange). I got it - finally - after thinking the whole day that I had been scammed by foreigners lol. I learned. If you spotted them, there was a cadre of super-smart CT personalities who spouted dependable market wisdom, along with the crypto clowns who simply made memes better and inadvertently brought joy to CT (btw if you think I’m referring to Connecticut please stop reading now). No mind-bending flash-loans, no eye-popping APYs, no Beeple no Punks no Apes. Just charts chatter and hope.

Then, enter summer of 2020: DeFi. This was the time of the brainiac. If Crypto had made you smarter, you could test your wits - and wallet - on DeFi. Because you had to be twice as smart to get most of this stuff.

Just one look at Fifi Kobayashi’s Twitter would have your head spinning for half a day. And she had/has peeps who, all day, talked jokingly about such geekery as batch-flash loans, MEV exploits, and other Mission Should Be Impossible stuff that I barely understood months ago, and have no chance at recall now. Especially after long exposure to the Degen Zoo of NFTs where floor is king, charts are widely considered unnecessary, and lists rule - white / allow / pre-mint / pre-white-allow / etc. DeFi was a thing that the bold (and perhaps mostly wealthy) did while the rest watched. To this day I have never yield-farmed. I have no regrets. A good stake with biscuits and vegetables on the side was my type of less-risky DeFi. And to those of you who bravely farmed before it became automated, I salute you.

Cryptokitties by Dapper Labs in Canada might have been the first NFT art project to boast big Eth price-tags. But the trend did not catch on…just yet. In the same year, the CryptoPunks, a free 10,000 profile picture (‘pfp’) project was introduced to the Ethereum blockchain by Larva Labs. Though the tech had been around for five years, NFTs had firmly taken root, and in the form of art. After DeFi summer, in the fall of 2020, came Art on Blockchain. Today it’s known simply as Art Blocks. Erick Calderon (aka Snow Fro) founded this generative art platform with help from sales proceeds of some of the his many CryptoPunks. The Punks had been silently climbing the dollar signs from 0 to superhero. When Art Blocks started CryptoPunks were firmly established; their fame and prices increasing exponentially. Both were experimental, and both CryptoPunks and Art Blocks turned out to be unprecedented successes in the art world and beyond. CryptoPunks, Art Blocks, Beeple, Bored Ape Yacht Club, and many, many other digital phenomena were about to usher in the NFT Era.

I could go on but I’ll stop here.

For while this might sound like a historical piece, it’s not. I’m simply providing a sketch of that history in order to show where and why these disconnects happened, in my opinion.

So Related Yet So Disconnected

Disconnect #1 - Crypto forced practitioners to level up or sink. Even if you weren’t a TA master, you developed an instinct to follow good takes on the market. Not necessarily to buy or sell, but simply to get one’s balance in a sea of volatility. Opening up an account on an exchange could be tedious; you had to pay attention to things you may have never before encountered, such as 2FA, or Google Authenticator or Authy apps. But these things could keep your funds safer, and SAFE are big letters in crypto. DeFi required more brains and boldness (and cash) than plain ol’ Crypto, so there’s the first disconnect. I say that because there are plenty of Crypto folks who didn’t participate at all in DeFi, not even the less risky activities such as staking, lending, and borrowing.

Disconnect #2 - DeFi offered insane opportunities not available previously in Crypto (or anywhere). But to be blessed in that space was risky (less so, today). Indeed, impermanent loss claimed many a wallet. All the advanced talk of yields, miner-extracted-value (not to mention MEV exploits), etc., etc., was water too-deep for many Crypto folk. But there’s an even bigger disconnect: between DeFi and NFTs. Why? Because NFTs (non-fungible tokens) are known as art although the technology is not limited to that. Art captivates, and is the perfect ambassador of this odd technology that is foreign to most. Art also requires the least thinking and prompts the most impulse and emotion of the three (Crypto, DeFi, NFTs). Thus it is that the final disconnect is the most severe: the Crypto Bro - though he or she doesn’t participate - knows more of DeFi and its practices than the NFT Bruh knows of either DeFi or Crypto. Because all Bruh has to do is look at the art and maybe the rarity score. No charts, TA, or Dune Analytics required. And sadly - particularly of late - not even a good eye.

Conclusion

Eras and divides are common and understandable. You can see how this happened with Crypto-DeFi-NFTs. But it shouldn’t stay that way, imo. Education and mutual respect is the passphrase here. NFT Bruhs - like the dude that didn’t know about other chains - need to learn about Crypto and DeFi. For example, plain multi-chain Crypto knowledge led me to easily find and peruse quality Off-Eth and nearly gasless marketplaces such as Singular, Mintbase, and Paras. Even Cardano is serious about getting into NFTs. Experience with staking (DeFi), for example, allows me to confidently recommend that activity to others who might have no DeFi history. Same with putting up NFTs as collateral for loans. In fact, I can’t imagine a chain that won’t have NFTs, can you? Crypto, whether it’s just coins, DeFi, or NFTs, is knowledge-first. The top NFT traders and collectors (such as FlamingoDAO) did a lot a lot of research to get there. Knowledge is the common thread. Each one, the Crypto Bro, the DeFi Degen, and the NFT Bruh would benefit from more knowledge about the other. Being involved with blockchain and never visiting other chains, or looking into and participating in any of the good opportunities in the space is counter-productive, and frankly, embarrassing. In my humble centralized opinion.

Elatedly yours

I promised artwork at the end of every post, and this time is no different. Scenery and architecture count as well, so may I delightfully present to you ‘Little Miami’ in Voxels world, a new virtual estate built for FlamingoDAO in summer 2022! [article updated: construction was in progess at time of first printing]